How Do Economists Make Forecasts? A Deep Dive into Economic Predictions

Estimated reading time: 8 minutes

Key Takeaways

- Economists use a combination of statistical analysis, mathematical modeling, and expert judgment to make economic forecasts.

- Key forecasting methods include econometric modeling, economic indicators analysis, time series analysis, qualitative forecasting, and the integration of machine learning and AI.

- Economic forecasts focus on key variables like GDP growth, inflation rates, unemployment figures, interest rates, consumer spending, and more.

- Challenges in economic forecasting include complex economic systems, unexpected events, difficulty in modeling human behavior, and political changes.

- Improving forecast accuracy involves using multiple models, integrating real-time data, leveraging machine learning, scenario analysis, and continuous evaluation.

Table of contents

- How Do Economists Make Forecasts? A Deep Dive into Economic Predictions

- Key Takeaways

- The Art and Science of Economic Forecasting

- Key Methods in Economic Forecasting

- Key Variables Under the Microscope

- Navigating the Challenges

- Improving Forecast Accuracy

- Practical Applications of Economic Forecasts

- Looking Ahead

- Frequently Asked Questions

In today's fast-paced global economy, understanding how economists make forecasts and predictions is more crucial than ever. These forecasts serve as vital tools for governments, businesses, and investors, helping them navigate through uncertain economic waters. Let's explore the fascinating world of economic forecasting and uncover the methods, challenges, and innovations that shape this essential practice.

The Art and Science of Economic Forecasting

Economic forecasting is far more than just educated guessing. It's a sophisticated blend of statistical analysis, mathematical modeling, and expert judgment. According to leading economic research, economists employ various methods to peek into the future of our economy, each with its unique strengths and applications.

Key Methods in Economic Forecasting

1. Econometric Modeling

At the heart of modern economic forecasting lies econometric modeling. This approach involves complex statistical methods that map relationships between different economic variables. According to Wikipedia's comprehensive overview, these models can range from simple equations to intricate systems containing hundreds of mathematical formulas, all working together to predict future economic outcomes.

2. Economic Indicators Analysis

Economists carefully monitor a set of leading economic indicators that serve as early warning signs of future economic conditions. These include:

- Unemployment rates

- Consumer confidence indexes

- Housing starts

- Manufacturing activity

- Stock market performance

3. Time Series Analysis

This method involves studying historical data to identify patterns and trends that might repeat in the future. As detailed by Harvard Business School, time series analysis helps economists understand seasonal variations, cycles, and long-term trends in economic data.

4. Qualitative Forecasting

Not all forecasting relies on numbers alone. The Delphi technique and scenario planning are qualitative methods that tap into expert opinions and assess potential future scenarios. These approaches are particularly valuable when dealing with unprecedented economic situations.

5. Machine Learning and AI Integration

The latest frontier in economic forecasting involves artificial intelligence and machine learning. These advanced computational techniques are revolutionizing how economists identify patterns in economic data and make predictions with greater accuracy.

Key Variables Under the Microscope

When making forecasts, economists focus on several crucial economic variables:

- GDP Growth: The primary indicator of economic health and expansion

- Inflation Rates: A key measure of price stability

- Unemployment Figures: Indicating labor market health

- Interest Rates: Affecting borrowing costs and investment

- Consumer Spending: A major driver of economic activity

- Industrial Production: Measuring manufacturing sector health

- Housing Market Indicators: Important leading indicators

- Stock Market Performance: Reflecting market sentiment

Navigating the Challenges

Economic forecasting isn't without its hurdles. The London School of Economics highlights several key challenges:

- Economic systems are incredibly complex with numerous interacting variables

- Unexpected events (like pandemics or geopolitical crises) can disrupt established patterns

- Historical data doesn't always predict future conditions accurately

- Human behavior and psychology are difficult to model

- Political and policy changes can dramatically impact economic outcomes

Improving Forecast Accuracy

To enhance the reliability of their predictions, economists employ several strategies:

- 1. Multiple Model Approach Using various models and methods helps validate predictions from different angles.

- 2. Real-Time Data Integration Incorporating current data and leading indicators improves forecast accuracy.

- 3. Machine Learning Enhancement Advanced algorithms help identify complex patterns that might be missed by traditional methods.

- 4. Scenario Analysis This helps account for uncertainty by considering multiple possible futures.

- 5. Continuous Evaluation Regular assessment and refinement of models based on their performance ensures ongoing improvement.

Practical Applications of Economic Forecasts

Economic forecasts serve multiple stakeholders:

- Government Agencies: For policy planning and budgeting

- Businesses: In strategic planning and investment decisions

- Investors: For market condition assessment

- Central Banks: In monetary policy decisions

- International Organizations: For global economic outlooks

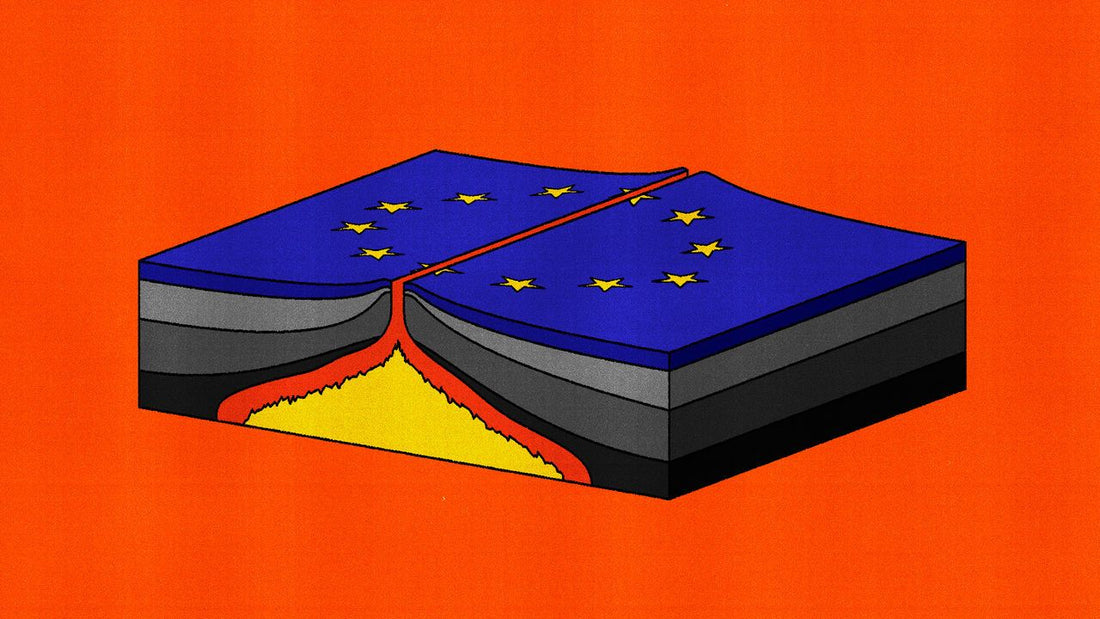

The European Commission notes that combining quantitative models with expert judgment typically produces the most robust forecasts.

Looking Ahead

As our world becomes increasingly interconnected and complex, the importance of accurate economic forecasting continues to grow. While no forecast can be perfect, the combination of advanced technology, sophisticated modeling, and expert analysis provides valuable insights for decision-makers across all sectors.

The future of economic forecasting looks promising, with artificial intelligence and machine learning opening new possibilities for more accurate predictions. However, the human element—the ability to interpret data in context and understand subtle market nuances—remains irreplaceable in the forecasting process. For professionals aiming to excel, expert training plays a critical role in boosting professional success.

Frequently Asked Questions

Q: How do economists use econometric modeling in forecasting?

A: Economists employ econometric modeling by using statistical methods to map relationships between economic variables, allowing them to predict future outcomes based on historical data.

Q: What are the challenges faced in economic forecasting?

A: Economic forecasting faces challenges such as the complexity of economic systems, unexpected events like pandemics or geopolitical crises, difficulty in modeling human behavior, and impacts of political and policy changes.

Q: How is machine learning improving economic forecasting?

A: Machine learning enhances economic forecasting by using advanced algorithms to identify complex patterns in data, improving prediction accuracy beyond what traditional methods might achieve.

Q: Why is the human element still important in economic forecasting?

A: Despite technological advancements, the human ability to interpret data in context, understand market nuances, and apply expert judgment remains critical and irreplaceable in the forecasting process.